Real Estate Investors: Here’s How to Calculate Cost-Per-Deal and Cost-Per-Lead

Successful real estate investors know their numbers and the two most important are:

- Cost-Per-Deal -The amount of money it costs to generate a single real estate deal.

- Cost-Per-Lead – The amount of money it costs to generate a single motivated seller lead.

These two metrics are critical to measuring the effectiveness of your marketing. In this article, you'll learn how to calculate these metrics but first, you need to understand…

What Successful Real Estate Investors Know (that newbies don't)

I'm about to reveal the worst kept secret in business.

Maybe you've never heard it put quite this way before but professional real estate investors have always known that:

You can buy seller leads. And, more importantly, you can buy real estate deals.

And I'm not referring to buying a list.

I'm talking about understanding the math behind your marketing. I'm talking about understanding how much you can spend to acquire a lead and how much you can spend to acquire a real estate deal.

Here's an example…

- James is a wholesaler that makes ~$5,000 in wholesale fees per deal

- His primary lead generation method is Google AdWords.

- For every $200 in Google Ad spend, James receives a motivated seller lead

- James closes 1 out of 10 seller leads he receives.

At this point, James has three choices:

- Pause or stop advertising on Google all together

- Continue advertising at his current ad budget.

- Increase his ad spend with Google Ads.

In this case, James is buying a lead for $200 and a wholesale deal for $2,000.

If these were your numbers, what would you do?

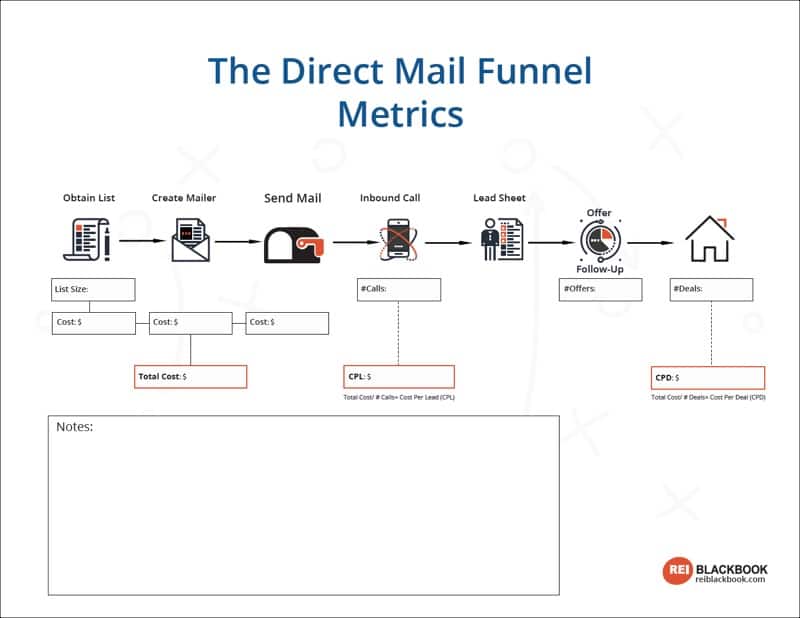

Worksheet: Cost-Per-Deal and Cost-Per-Lead

Let's say James decides to start experimenting with direct mail to get motivated seller leads.

Assuming he is using software like REI BlackBook to track where his leads are coming from, James will know (to the penny!) whether direct mail is a more profitable way to buy seller leads and wholesale deals.

The only numbers James needs to calculate Cost-Per-Deal and Cost-Per-Lead are in this simple worksheet:

(Click here or on the image below to download a fillable PDF version of this worksheet)

Let's have a look at these numbers in turn:

- List Size – How many addresses are on this mailing list?

- List Size (Cost) – How much did it cost to purchase this list? (List broker fees, etc)

- Create Mailer (Cost) – How much did it cost to create the mailer? (Graphic design, printing, etc)

- Send Mail (Cost) – How much did it cost to send the mail? (Postage, etc)

- # Calls – How many inbound calls did you receive from this campaign? (Use a software like REI BlackBook to track where your leads are coming from)

- Cost-Per-Lead (CPL) – Total Cost / # Calls = CPL

- # Offers – How many contracts did you write from this campaign?

- # Deals – How many deals did you close from this campaign?

- Cost-Per-Deal (CPD) – Total Cost / # Deals = CPD

Let's put some numbers into the worksheet so James can make a data-driven decision about his marketing:

List Size = 5,000

Expenses

List Cost = $500

Postcard Cost (mailed) $2,500

Total Cost = $3,000

# Calls = 50

Cost-Per-Lead (CPL) = $60

# Deals = 2

Cost-Per-Deal (CPD) = $1,500

With these numbers, James would be crazy not to consider investing more in direct mail.

The Ongoing Battle with Your “Cost-Per” Metrics

Can you see how James is “buying” leads and deals?

In the case of AdWords, he can buy a deal for $2,000. In the case of direct mail, it's costing $600.

Of course, it's not quite this simple. The truth is that, while the current numbers show that direct mail has a better return on investment (ROI), these numbers will change over time.

As an example, the direct mail list will become “fatigued” and James will be forced to buy a new list or add to his existing one. Competition will enter or exit Google Ads causing click costs and conversion rates to fluctuate.

This, and a thousand other variables will cause Cost-Per-Lead and Cost-Per-Deal to fluctuate.

To run a successful real estate investment business you'll need to monitor these metrics on a weekly basis to know how much it's costing you to buy seller leads and real estate deals.

What You Should Do Now:

- Get started with REI Blackbook for FREE: Get 14 days FREE access to our software and start converting more leads into deals.

- If you'd like to learn the exact strategies our power users are implementing to generate motivated seller leads consistently, check out our Motivated Seller Guide.

- If you'd like to learn how our team can build out your REI Blackbook system FOR you, head to our implementation page.

- If you know another real estate investor who'd enjoy reading this page, share it with them via email, Linkedin, Twitter or Facebook.

Recent Blog Posts

Get Started with REI BlackBook Today

Get started today and get 14 days free access

Without REI BlackBook we would not have gotten as far as we have as fast as we have. It is an invaluable swiss army knife for our business.

Andy Wright

Mountain Shamrock Properties